Things need to Know : First time buying home in Alberta

Financial Prerequisites:

Down Payment: While the traditional 20% down payment is ideal, programs like the First-Time Home Buyer Incentive (FTHBI) allow borrowing 5-10% from the government. Remember, a higher down payment translates to lower mortgage payments and less reliance on the program.

Mortgage Pre-Approval: This crucial step assesses your borrowing capacity and provides leverage in negotiations. Talk to multiple lenders to compare rates and terms.

Household Income: Understand your comfort level with monthly mortgage payments considering other expenses. Tools like affordability calculators can guide you.

Government Programs:

Alberta and Canada offer valuable incentives for first-time buyers:

FTHBI: As mentioned, this shared-equity program helps with down payments. Remember, you'll owe a portion of the home's appreciation back to the government when you sell or after 25 years.

Alberta's PEAK Program: This offers an interest-free second mortgage for up to 5% of the purchase price for low-income earners.

First-Time Home Buyers' Tax Credit: Claim a non-refundable credit of $10,000 to ease the financial burden.

Finding your Dream Home:

Define your Needs and Budget: Location, size, amenities - prioritize your must-haves and be realistic about your budget.

Research Neighborhoods: Explore different areas, considering factors like commute, schools, and community vibe.

Work with a Realtor: A reputable realtor can guide you through the process, negotiate on your behalf, and access off-market listings.

The Negotiation Game:

Be Informed: Research comparable properties in the area to understand fair market value.

Present a Strong Offer: Consider contingencies like home inspection and financing approval deadlines.

Stay Calm and Patient: Negotiations can take time. Be prepared to walk away if the seller's terms don't align with your budget.

The Closing Process:

Legal Representation: A lawyer can protect your interests and ensure smooth documentation.

Home Inspection: Identify potential repairs and negotiate accordingly.

Insurance: Secure homeowner's insurance before closing.

Beyond the Purchase:

Budgeting and Maintenance: Plan for ongoing expenses like property taxes, utilities, and home maintenance.

Community Engagement: Get involved in your neighborhood and build connections.

Alberta-Specific Resources:

Canada Mortgage and Housing Corporation (CMHC): Provides information and resources for first-time buyers.

Alberta Housing: Offers programs and financial assistance for Alberta residents.

Real Estate Council of Alberta (RECA): Regulatory body for real estate professionals in Alberta.

Conclusion:

Purchasing a home is a significant life decision. Do your research, seek professional guidance, and make informed choices. With careful planning and resourcefulness, you can confidently navigate the first-time home buying journey in Alberta and make your dream of homeownership a reality.

Related posts:

Canada’s housing affordability crisis continues in 2025 despite falling rates and modest price drops. Discover the key factors keeping homes out of reach for many Canadians, from supply shortages to policy misalignments and rental market pressures.

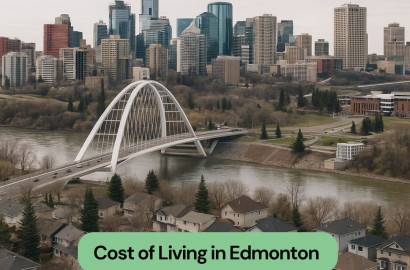

Wondering about the cost of living in Edmonton? This 2025 guide covers rent, home prices, utilities, groceries, and more to help you budget for life in Alberta’s capital.

Why Canada’s Housing Affordability Crisis Isn’t Over Yet

Why Canada’s Housing Affordability Crisis Isn’t Over Yet  Cost of Living in Edmonton (2025) - Rent, Homes & Daily Expenses

Cost of Living in Edmonton (2025) - Rent, Homes & Daily Expenses  CMHC Mortgage Loan Insurance Update 2025 | MLI Select Premium Changes

CMHC Mortgage Loan Insurance Update 2025 | MLI Select Premium Changes  Big GST Relief for First-Time Home Buyers in Canada – Here’s What You Need to Know

Big GST Relief for First-Time Home Buyers in Canada – Here’s What You Need to Know  Learn Home Maintenance Checklist for Canadian Homeowners (By Season)

Learn Home Maintenance Checklist for Canadian Homeowners (By Season)